Innovate or you perish- Deputy speaker Tayebwa tells insurance companies

The deputy speaker of parliament, Thomas Tayebwa has told insurance companies that in this era of stiff competition, they ought to be as innovative as they can or else they will be obsolete.

“We need to learn from the best on the continent to understand which risks are people having which demand that they take up insurance. Innovation will drive all this,” Tayebwa said.

Keep Reading

He was on Friday evening speaking as chief guest during the 2023 annual insurance innovation awards organised by the Insurance Regulatory Authority at Kampala Serena Hotel.

The awards were held under the theme, ‘"Insurevate: Igniting excellence in the insurance sector."

Tayebwa said innovation will see insurance companies come up with specific products tailor-made for their customers and this will drive penetration of insurance in the country.

“A country like Uganda, the Small and Medium Enterprises contribute aver 2.5 million jobs, 90% of the private sector manufacturing output is from these people, they control the economy. We need to give them the confidence to take up insurance. For these SMEs, most of the insurance they take up is the one which is mandatory but if it wasn’t for that, not many would take up insurance,” Tayebwa said.

Building trust

The deputy speaker also tipped insurance companies on cultivating trust from Ugandans, noting that these can be through claims payout.

“We need to see a way of strengthening the trust. This is an issue of trust. Taking up a policy is very easy but making a claim and being paid is the hardest part. We need to improve on the issue of trust so that people know when I am insured, it is the right thing I did. I don’t need to lobby or report to the regulator to be paid,” Tayebwa said.

He also urged insurance companies to be on the lookout for fraudsters in their clients who want to be paid what is not due to them.

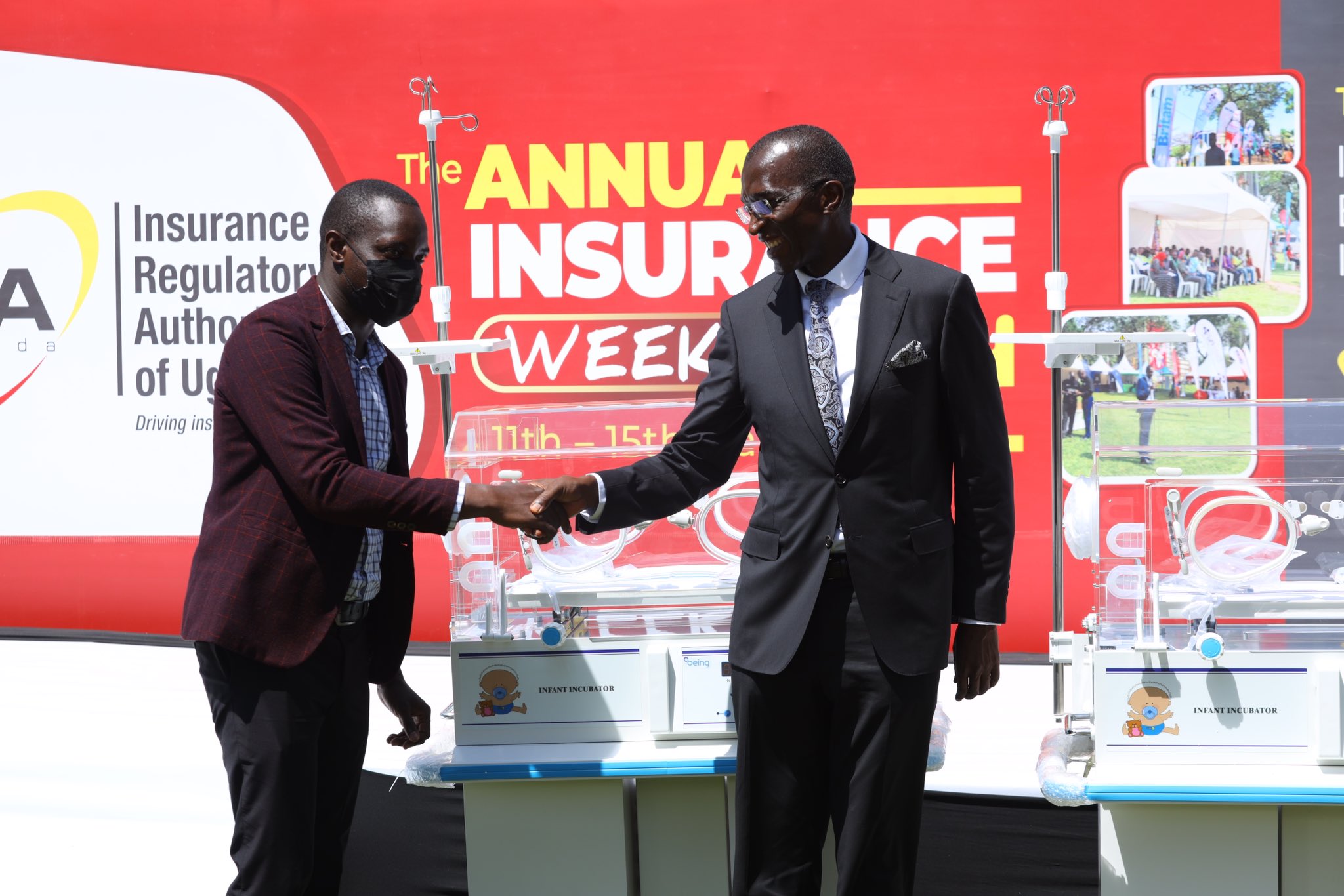

The Insurance Regulatory Authority CEO, Alhaj Ibrahim Lubega Kaddunabbi underscored the role of innovation in helping deepen insurance.

“As Insurance Regulatory Authority, we have always believed in pushing the boundaries of what is possible. From leveraging cutting edge technology to enhance customer solutions to serve customer demands, innovation is indeed a very good ingredient for insurance,”Kaddunabbi said.

“I want to reaffirm our commitment to push our boundaries to what is possible. Similarly, I want to challenge sector players to embrace change continuously. We should have a future where our industry thrives on innovation and resilience.”